Investing

Where it Counts

Information For Investment Advisors

Investing With a Mortgage

Investment Corporation

By investing with Cambridge Mortgage Investment, your clients can diversify their investments, secure their capital against tangible assets and experience consistent and long-term returns; making us the prime choice as a mortgage investment corporation.

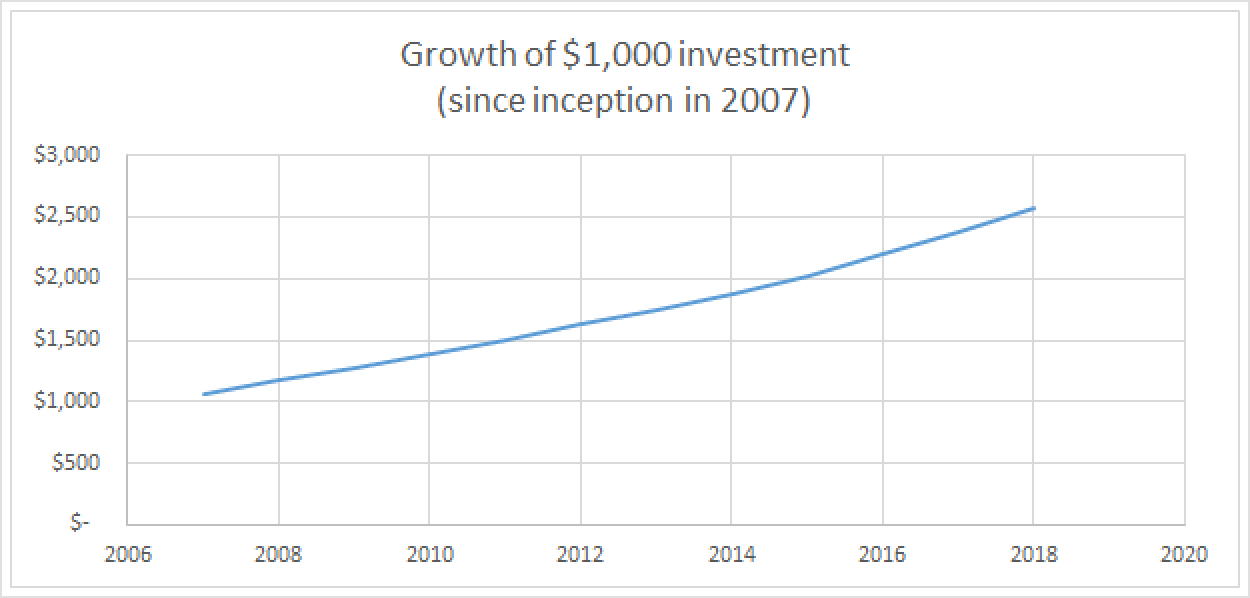

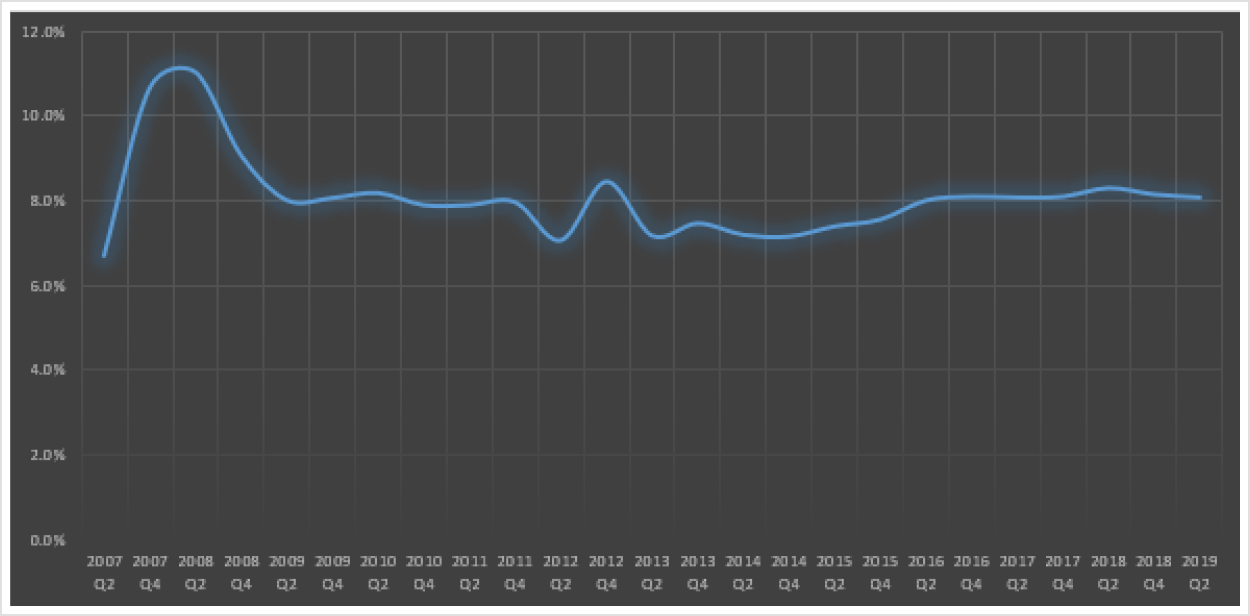

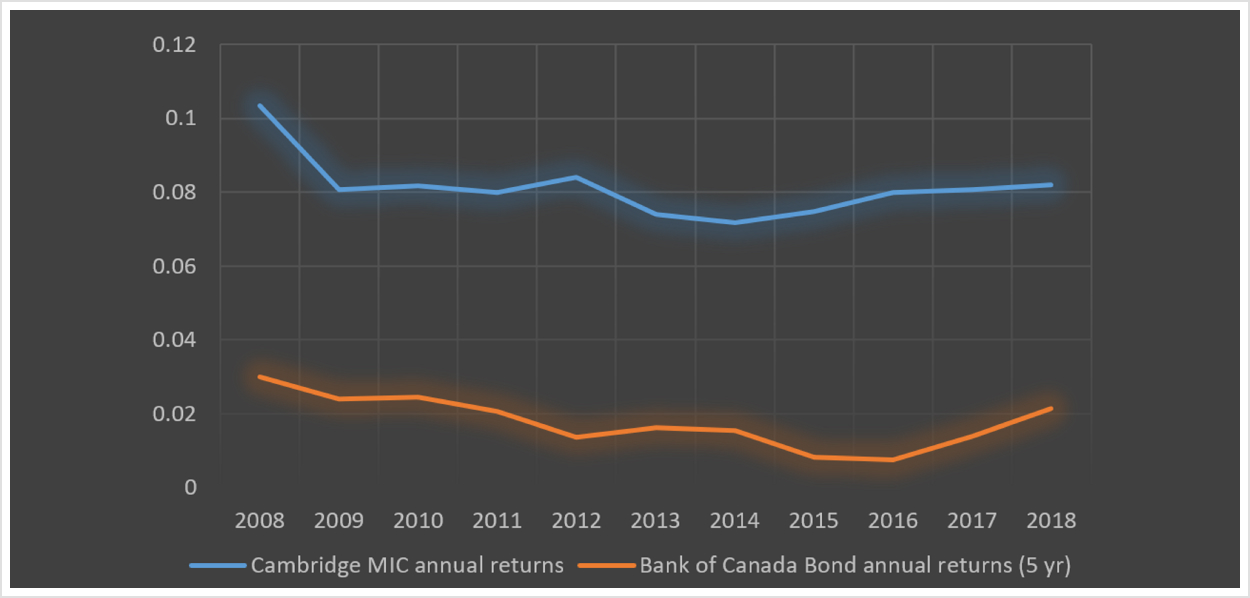

- Returns of greater than 7% per annum since inception

- Diversified pool of mortgages

- Short portfolio duration allowing for limited interest rate risk

- First and second position mortgages, registered against desirable residential properties

- Low weighted average loan to value

- Listed on Fundserv (code: “CMC”)

- Consistent returns over an extended period of time

- Opportunity to hold a significant income-producing asset-backed by tangible assets

Why Choose Cambridge Mortgage Investment Corporation?

Experience

30 years of experience in the industry has provided our team with the knowledge and tools to create and structure conservative non-institutional mortgages while maintaining a diversified mortgage portfolio.

Approach

Our practical risk management approach and well-defined lending practices maximize returns for investors while mitigating as much risk as possible.

Track Record

Since our inception in 2007, Cambridge has met investor expectations by effectively managing portfolio risks and returns, thereby providing investors with the confidence to make recurring investments with us over multiple years.

Adding Cambridge to Your Clients’ Investment Portfolio

Diversification

Adding a consistent income-producing asset through investments in our pool of mortgages, which are secured by tangible Canadian real estate, will enable your clients to effectively diversify their investment portfolios. Their cash equivalents, common stocks and bonds can be better diversified by adding real estate assets to the mix.

Consistent Returns

Through careful organic growth, conservative risk management and well-defined mortgage lending practices, we have consistently delivered returns that meet most of our investor expectations. We seek out a conservative mix of mortgage investments with acceptable returns but are less volatile and thereby strive to limit your clients’ exposure to risk.

Capital Preservation

Our main objective is to preserve your clients’ capital through smart investments and innovative lending practices. Our diverse mortgage portfolio is secured by real estate in Western Canada, thereby safeguarding your clients’ investments while delivering historically consistent returns.

Invest with Cambridge Mortgage

Investment Corporation

The success of a mortgage investment corporation depends on the first-hand knowledge, track record and forward-thinking mindset of its management. At Cambridge, clients experience a boutique operation with seasoned professionals, bringing them decades of real estate market experience. Our results and growth mentality emphasize our ability to deliver superior results for our investors.

Invest with Cambridge Mortgage Investment Corporation

The success of a mortgage investment corporation depends on the first-hand knowledge, track record and forward-thinking mindset of its management. At Cambridge, clients experience a boutique operation with seasoned professionals, bringing them decades of real estate market experience. Our results and growth mentality emphasize our ability to deliver superior results for our investors.

What Our Customers Are Saying

Frequently Asked Questions

We are currently permitted to distribute exempt market shares of Cambridge in BC, Alberta and Ontario through registered exempt market dealers and investment dealers. Please contact us for further information on how to invest.

Returns from the MIC are taxed as “interest from Canadian sources”. You will be issued T5s after the end of the calendar year.

Currently, Cambridge does not have a system set up for small monthly contributions, preferring lump sum investments. However, we are considering implementing systems in the future to accommodate client requests and preferences.