Wisely

Information For Individual Investors

What is a Mortgage

Investment Corporation?

As a mortgage investment corporation, Cambridge Mortgage Investment creates wealth and opportunities for investors by enabling them to invest in a diversified, actively managed portfolio of mortgage assets, including residential, first, second and construction loans. Our experienced management team have achieved consistent and substantial returns for investors for over a decade.

- Substantial returns and comparatively low volatility of investments

- Diversified pool of mortgage assets secured by tangible assets

- Consistent income through quarterly dividends

- Practical approach to lending and investing

How Does a Mortgage Investment

Corporation Work?

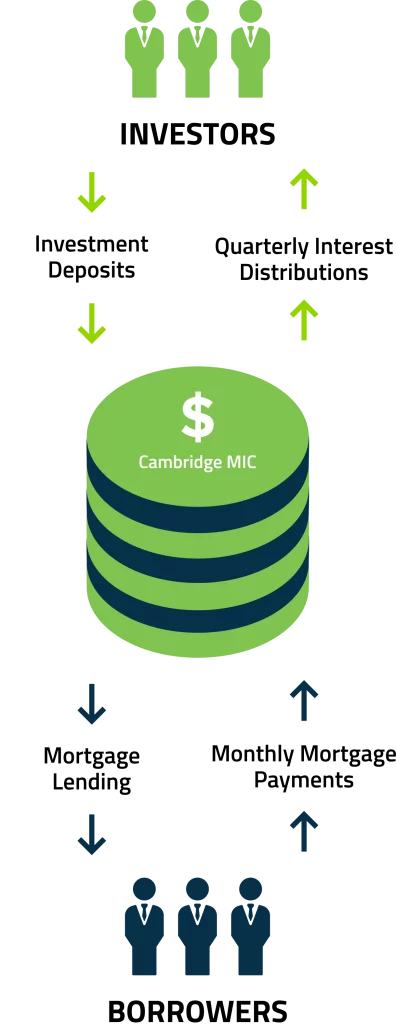

Our organic growth stems from our structured, simplified investment approach. We pool together shareholder capital, lending it to borrowers, allowing us to pay dividends to our investors from income earned through interest and fees. Our conservative approach to alternative mortgage lending, with a reasonable weighted average loan-to-value, has allowed us to provide consistent, significant and long-term results to our shareholders.

Experience

30 years of experience in the industry has provided our team with the knowledge and tools to create and structure conservative non-institutional mortgages while maintaining a diversified mortgage portfolio.

Approach

Our practical risk management approach and well-defined lending practices maximize returns for investors while mitigating as much risk as possible.

Track Record

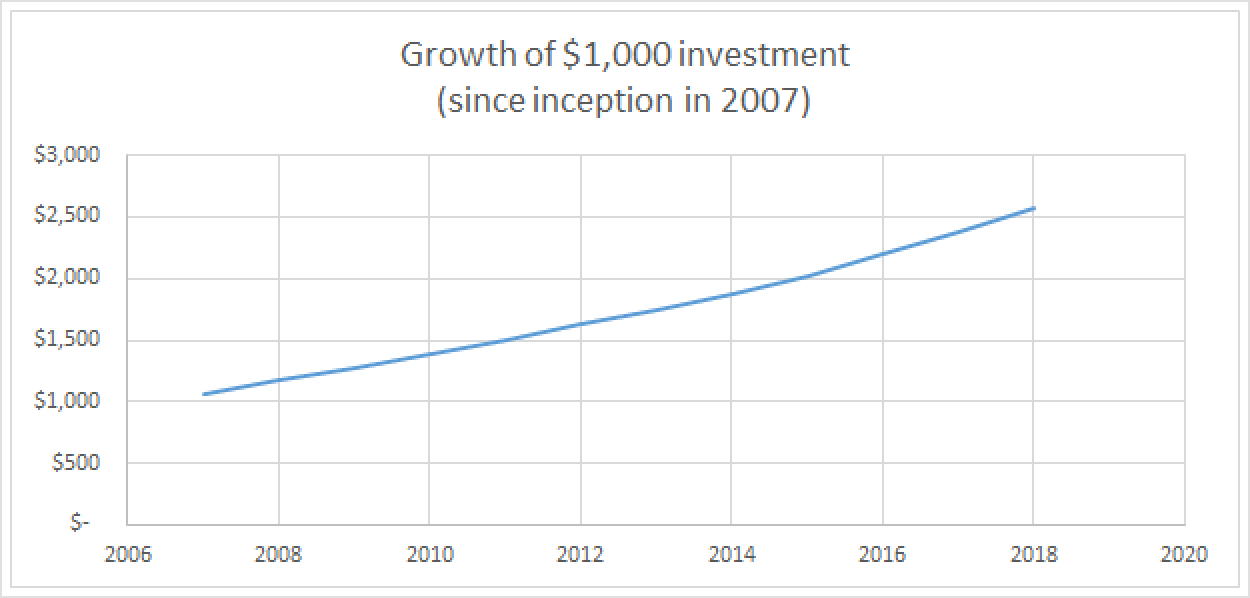

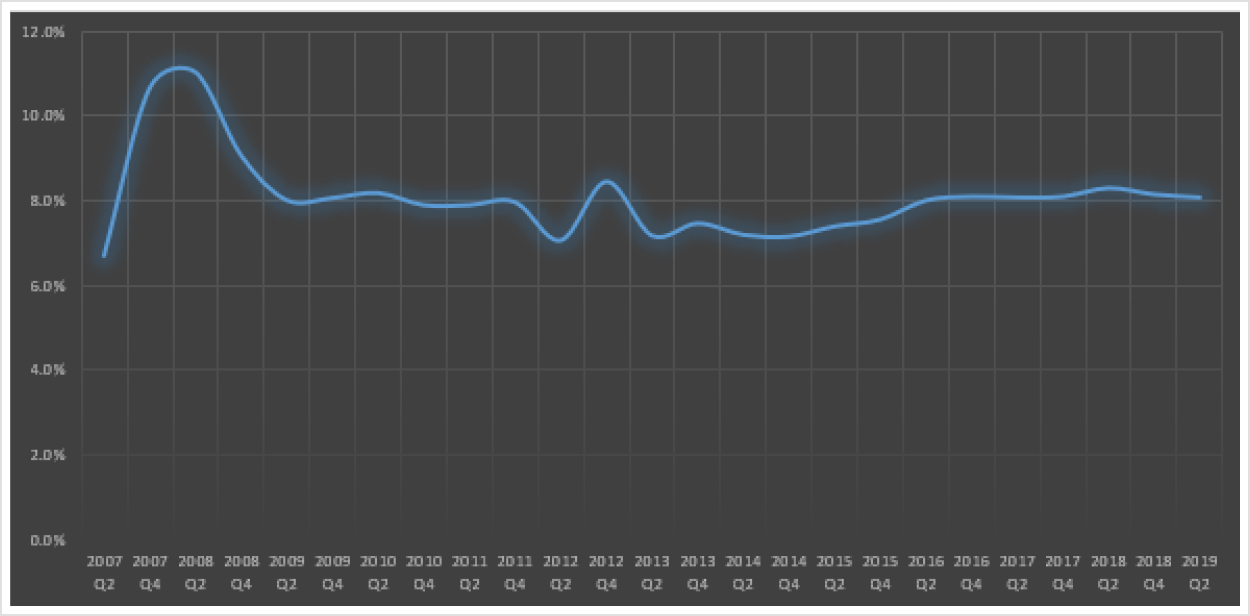

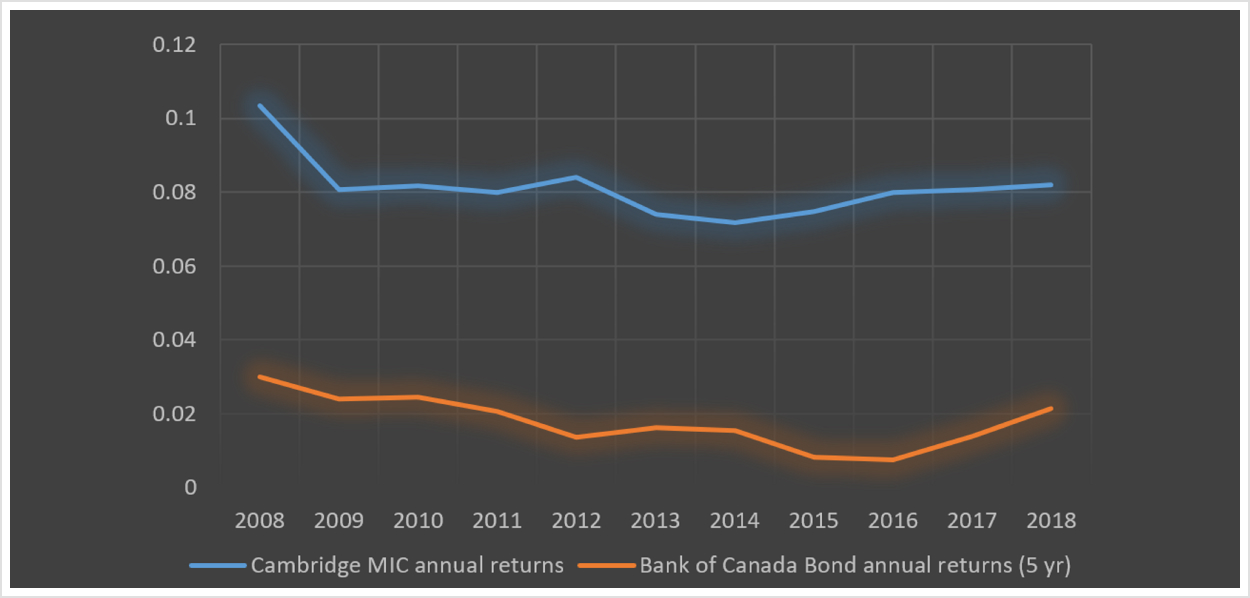

Since our inception in 2007, Cambridge has met investor expectations by effectively managing portfolio risks and returns, thereby providing investors with the confidence to make recurring investments with us over multiple years.

Your Investment

TFSAs

Introduced in 2009, the Tax-Free Savings Account (TFSA) is an account where any gains through investment products, including mortgage assets, are tax-free. You can withdraw money from your TFSA at any time without incurring a fee. Our advisors aim to provide you with consistent rewards through your TFSA.

Unregistered Investments

Lorem ipsum dolor sit amet, has te denique instructior, cum apeirian deseruisse in, atqui blandit salutandi cu nec. Has at equidem officiis atomorum, dolorum nusquam sit no. Cum tamquam eleifend platonem an, vix in consulatu iracundia. Ei atomorum consequat complectitur has.

RRSPs

Your Registered Retirement Savings Plan (RRSP) is a registered product with the Government of Canada, an account and investment portfolio designed to help plan for your future. It allows you to hold a variety of investments, including mortgages while remaining tax-deductible. We aim to provide substantial returns to your RRSP.

RRIFs

A registered retirement income fund (RRIF) is an excellent option for retirees to receive consistent income. Your RRIF will continue to disburse funds created in your RRSP, and although tax-sheltered while in the fund, it is taxed once withdrawn. Regular withdrawals must be made according to a pre-arranged schedule.

Looking to Borrow?

Contact us to learn more about our borrowing options for existing customers. Cambridge Mortgage Investment is here to serve you.

Looking to Borrow?

Contact us to learn more about our borrowing options for existing customers. Cambridge Mortgage Investment is here to serve you.

The Benefits of Investing In a Mortgage

Investment Corporation

Investment returns have historically been greater than 7% per annum

A diversified portfolio of mortgages with a low weighted average loan-to-value

Our investments are RRSP, RRIF & TFSA eligible

Investments are secured by real estate in Western Canada

Frequently Asked Questions

Investors’ funds are placed in a pool (thereby securing them as shareholders), which is used to lend out first, second or construction mortgages to borrowers. The fees and interest paid by borrowers are distributed to shareholders through dividends.

Returns are calculated and distributed quarterly. Each investment can be tailored to pay out cash, shares, or a combination of both (i.e. 50% cash/50% shares). An updated investor statement and letter from the President are included with each distribution.

Process

Discuss with our team about participating in our mortgage investment fund. We will provide you with an Offering Memorandum and Fact Sheet.

Invest your designated funds into our pool. You will be entitled to an appropriate number of preferred shares based on the size of your investment.

Receive your returns every quarter, which can be paid out in cash (EFT), shares, or a combination of both. You will also receive an updated investor statement and letter from the President with each distribution.